Communication Tower Construction in Brazil

2025-10-25

Communication tower construction in Brazil forms the crucial underpinning of the nation's expansive and evolving digital infrastructure. As the largest country in South America and a significant global economy, Brazil presents a complex tapestry of challenges and immense opportunities in the deployment and enhancement of wireless communication networks. The sheer scale of its territory, encompassing dense urban centers, vast agricultural lands, remote rainforests, and extensive coastlines, necessitates a robust and constantly growing network of communication towers.

This infrastructure is vital not only for basic mobile voice and data services but also for enabling advanced technologies like 5G, the Internet of Things (IoT), and supporting the digitalization of various economic sectors. The relentless growth in data consumption, coupled with regulatory mandates and strategic industry shifts, creates a continuous and pressing demand for new tower builds and upgrades across the country.

This article provides an in-depth exploration of communication tower construction in Brazil, examining the primary market drivers, detailing the intricate construction lifecycle, identifying the key players shaping the industry, analyzing the significant hurdles faced, and projecting future trends in this dynamic sector. Understanding these elements is essential for anyone involved in Brazil's telecommunications landscape, from network operators and infrastructure providers to policymakers and investors.

Key Drivers for Tower Construction in Brazil

The accelerated demand for communication tower construction in Brazil is propelled by a confluence of powerful factors. These range from explicit regulatory requirements linked to next-generation network deployments to fundamental shifts in consumer behavior and overarching government strategies aimed at fostering digital inclusion and economic development. Each driver contributes significantly to the ongoing investment in physical network infrastructure.

5G Rollout Obligations and Spectrum Milestones

Arguably the most significant catalyst currently is the nationwide implementation of 5G technology. Following a landmark spectrum auction, Brazil's telecommunications regulatory agency, ANATEL, imposed stringent coverage obligations on the mobile network operators (MNOs) that acquired 5G licenses.

Major players such as Vivo (part of Telefônica Brasil), Claro Brasil, and TIM Brasil are legally bound to deploy 5G services according to a predefined schedule, targeting specific population percentages and geographical areas, including major cities, federal highways, and progressively smaller municipalities. The potential penalty for failing to meet these critical milestones—including the forfeiture of expensive spectrum rights—transforms network expansion from a purely market-driven decision into a regulatory imperative.

This mandate compels operators to undertake substantial capital expenditure programs focused on building thousands of new 5G-ready sites, necessitating extensive communication tower construction in Brazil to support the required network densification and coverage expansion. The structured timeline provides a degree of predictability for the tower industry, enabling infrastructure providers to plan build programs in coordination with operator needs.

Rising Mobile Data Consumption

Parallel to the 5G rollout is the exponential growth in mobile data consumption among Brazilian users. Factors contributing to this surge include increasing smartphone penetration, the widespread availability of affordable data plans, and the burgeoning popularity of data-intensive applications. Video streaming platforms (like Netflix, YouTube, Globoplay), complex mobile gaming, extensive social media engagement (WhatsApp, Instagram, Facebook), and cloud-based services are now integral parts of daily life for millions.

This escalating data usage places immense strain on the capacity of existing 4G LTE networks, leading to network congestion and degraded user experiences, particularly in densely populated urban zones. To alleviate this pressure and maintain service quality, operators must continuously enhance network capacity. This involves deploying additional spectrum bands, upgrading equipment on existing towers, and, crucially, constructing new cell sites to increase network density.

Communication tower construction in Brazil is therefore directly driven by the need to accommodate this relentless growth in data traffic and ensure networks can deliver the speed and reliability users demand.

Operator Sale-Leaseback Monetization Wave

The structure of the Brazilian telecom market itself is a major driver of construction activity, specifically through the widespread adoption of the sale-and-leaseback (SLB) model for tower assets. Over the past decade, MNOs have increasingly divested their portfolios of passive infrastructure – the physical towers, land leases, and power systems – to specialized independent tower companies (TowerCos).

Following the sale, the MNO enters into a long-term agreement to lease space on those same towers from the TowerCo. This strategic maneuver allows operators to monetize non-core assets, removing significant capital tied up in physical infrastructure from their balance sheets. The proceeds from these sales are then typically reinvested into core business activities, such as acquiring expensive 5G spectrum, purchasing advanced radio access network (RAN) equipment, expanding fiber optic networks, and developing new digital services.

This trend has fueled the rapid growth of TowerCos in Brazil, which now own and manage the vast majority of the country's towers. As part of these SLB deals, TowerCos often commit to extensive Build-to-Suit (BTS) programs, agreeing to construct a specified number of new towers tailored to the operator's future network requirements, further stimulating communication tower construction in Brazil.

Government Initiatives for Rural Coverage

Bridging the digital divide remains a significant national priority for Brazil, given its vast size and the disparities in connectivity between urban and rural areas. Various government initiatives aim to extend broadband access to underserved or unserved communities, particularly in remote regions. The Telecommunications Services Universalization Fund (FUST) is designed to finance projects that promote universal access.

More recently, the federal government's Novo PAC (Growth Acceleration Program) includes specific provisions and funding allocations for expanding digital infrastructure, including mobile broadband networks. These programs often create targeted demand for communication tower construction in Brazil's interior, agricultural zones, and other areas lacking adequate connectivity.

Operators and TowerCos may receive subsidies or favorable financing conditions to build infrastructure in these less commercially attractive regions, aligning business objectives with national development goals. This government push ensures that tower construction is not solely concentrated in profitable urban centers but also extends to areas crucial for social inclusion and economic development across the country.

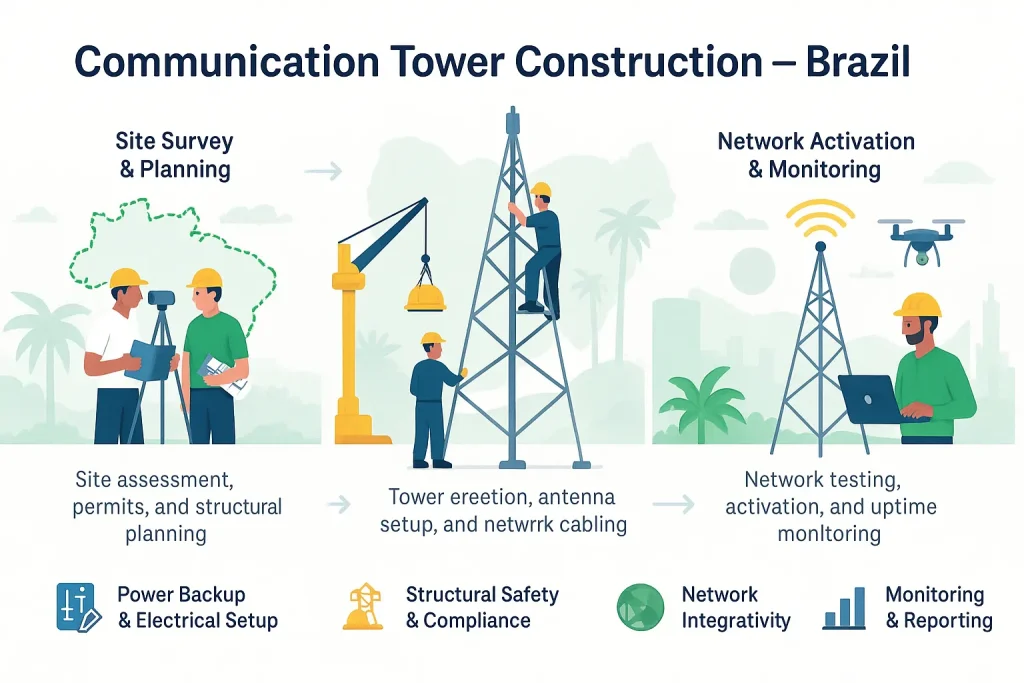

The Communication Tower Construction Process in Brazil

The journey from identifying a network coverage gap to having an operational communication tower involves a complex, sequential process fraught with potential challenges. Communication tower construction in Brazil requires expertise in diverse fields including real estate, regulatory affairs, civil engineering, logistics, and telecommunications technology.

Site Acquisition

This initial phase is foundational and often dictates the success and timeline of the entire project. It begins with radio frequency (RF) engineers identifying specific geographic areas where a new cell site is needed to improve coverage or capacity. Site acquisition specialists then scout potential locations within that target area. This involves finding suitable parcels of land – typically small plots – that meet technical requirements (e.g., elevation, proximity to power and fiber, lack of obstructions).

The next crucial step is negotiation with landowners to secure long-term lease agreements or, less commonly, outright purchase of the land. This requires navigating complex property laws, verifying land titles, and agreeing on commercially viable terms.

Environmental assessments may also be necessary at this stage to identify potential impacts on sensitive ecosystems, archaeological sites, or protected areas, especially in regions like the Amazon or coastal zones. Securing the physical location under appropriate legal terms is a critical prerequisite before any construction can commence.

Permitting and Licensing

Obtaining the necessary permits and licenses is frequently cited as the most time-consuming and unpredictable stage of communication tower construction in Brazil. The regulatory framework is multi-layered and often lacks uniformity across different jurisdictions. Key approvals typically include:

- ANATEL Licenses: Brazil's national telecommunications agency regulates spectrum usage and sets technical standards for towers and equipment. Operators need licenses to operate the frequencies transmitted from the tower.

- Municipal Permits: Local city or town councils (prefeituras) control land use zoning and issue building permits (alvará de construção). Requirements regarding tower height, setbacks, aesthetic considerations (especially for stealth towers), and required documentation can vary drastically from one municipality to another. Public consultations or hearings may also be required.

- Environmental Licenses: Depending on the location and potential impact, permits from state or federal environmental agencies (like IBAMA or state-level bodies) may be necessary. This is particularly relevant in ecologically sensitive areas.

- Aviation Clearances: For towers exceeding certain height thresholds, approval from aviation authorities (DECEA) is required to ensure they do not pose a hazard to air navigation. This includes requirements for marking and lighting. Navigating this intricate web of approvals demands specialized knowledge of local regulations and strong relationships with various government bodies. Delays in permitting are a common cause of frustration and can significantly impact network rollout timelines.

Civil Works and Foundation

With permits in hand, physical construction starts with civil works. The site must be prepared, which might involve clearing vegetation, grading the land, and constructing an access road capable of handling heavy vehicles and equipment. The most critical element of this phase is the foundation. Engineers design the foundation based on detailed geotechnical surveys that assess soil composition, stability, and load-bearing capacity. Foundation types vary widely, from simple concrete pads in stable soil to deep piles or complex raft foundations in challenging conditions (e.g., marshy ground, steep slopes).

The foundation must be robust enough to support the immense weight of the tower structure and withstand significant wind loads, which can be substantial, particularly for tall lattice towers. Pouring and curing the concrete foundation requires careful quality control and adherence to precise engineering specifications. Any errors at this stage can compromise the entire structure's safety and longevity.

Tower Erection and Assembly

Once the foundation is ready, the prefabricated tower components are transported to the site. This involves complex logistics, especially for large lattice tower sections or long monopole segments, potentially requiring specialized trucks and careful route planning. Skilled erection crews, certified for working at height, then begin assembling the tower. For lattice towers, this involves bolting together steel angles or tubes section by section using cranes.

Monopoles are typically assembled on the ground in segments and then lifted into place as a single unit or in large sections. Guyed masts require careful tensioning of the supporting cables anchored to surrounding points. Throughout the erection process, adherence to strict safety protocols is paramount to prevent accidents. The alignment and verticality of the structure are constantly checked using surveying instruments. Common tower types include:

- Lattice Towers: Self-supporting structures made of bolted steel angles. Very strong and common for heavier loads.

- Monopoles: Single-pole structures, often used in urban areas due to their smaller footprint.

- Guyed Masts: Slender towers supported by tensioned cables anchored to the ground. Require more land area.

Equipment Installation and Commissioning

The final construction phase involves installing the active telecommunications equipment onto the completed tower structure. Technicians mount antennas at designated heights and orientations (azimuth and tilt) according to the RF plan. Coaxial cables or fiber optic lines are run from the antennas down to the equipment shelter or cabinets at the base. Radio units, baseband processing equipment, power systems (rectifiers, batteries, backup generators), and transmission equipment (microwave dishes or fiber optic terminals) are installed and interconnected. The site needs to be connected to the electrical grid or equipped with a standalone power solution.

Once all hardware is installed, the site undergoes rigorous testing and commissioning. Engineers verify equipment functionality, signal strength, coverage patterns, and connectivity to the core network. After successful testing, the site is integrated into the MNO's live network and begins carrying commercial traffic, marking the completion of the communication tower construction process in Brazil.

Key Players in Brazilian Tower Construction

The ecosystem supporting communication tower construction in Brazil is multifaceted, comprising several distinct types of organizations that collaborate and compete to build out the nation's wireless infrastructure. Each player brings specialized capabilities to the table.

Independent Tower Companies (TowerCos)

These entities are now the central figures in the Brazilian tower landscape. Having acquired the majority of MNOs' passive infrastructure assets, TowerCos own, operate, and manage vast portfolios of communication towers. They are primarily responsible for financing and executing new tower construction projects, driven by long-term Master Lease Agreements (MLAs) with MNOs. Their business model revolves around maximizing tenancy ratios (the number of operators sharing a single tower) to generate returns on their infrastructure investments. Key international and regional TowerCos dominating the Brazilian market include:

- American Tower Brasil: Possessing one of the largest tower counts in the country, leveraging its global scale and experience.

- SBA Communications Brasil: A major competitor with a significant and growing portfolio, known for operational efficiency.

- IHS Towers Brasil: Expanded significantly through strategic acquisitions, bringing its emerging market expertise to Brazil.

- Phoenix Tower International: An active acquirer and builder, rapidly increasing its footprint.

- QMC Telecom Brasil: A prominent player with a strong focus across Latin America, offering diverse infrastructure solutions. These companies undertake large-scale Build-to-Suit (BTS) programs, constructing hundreds or thousands of new sites annually based on operator requirements. They manage the entire lifecycle from identifying locations to final commissioning.

Mobile Network Operators (MNOs)

Although MNOs have largely outsourced tower ownership, they remain the primary customers and the ultimate drivers of demand for new construction. Vivo (Telefônica Brasil), Claro Brasil (part of América Móvil), and TIM Brasil (part of Telecom Italia group) dictate where and when new towers are needed based on their network coverage strategies, capacity requirements, 5G deployment plans, and regulatory obligations.

They provide the technical specifications for new sites, including desired height, equipment load, and backhaul needs. Their capital expenditure budgets and strategic priorities directly influence the volume and pace of communication tower construction in Brazil. Smaller regional operators or new entrants (like Brisanet or Unifique, which acquired 5G spectrum) also contribute to construction demand, particularly in specific regions or for niche applications like Fixed Wireless Access (FWA).

Construction and Engineering Firms

These specialized companies are responsible for the physical execution of tower construction projects. They possess the engineering expertise, skilled labor force (including certified climbers and riggers), and heavy equipment (cranes, excavation machinery) required for site preparation, foundation work, tower erection, and equipment installation.

They typically work as subcontractors for TowerCos or, occasionally, directly for MNOs. The quality and safety of their work are critical to the structural integrity and operational reliability of the towers. Brazil has a well-developed sector of national and regional construction firms specializing in telecom infrastructure, playing a vital role in the ecosystem.

Challenges in Communication Tower Construction

Despite the strong demand, executing communication tower construction in Brazil is fraught with significant challenges that can impact costs, timelines, and overall project feasibility. These hurdles stem from the country's geography, regulatory system, economic factors, and operational realities.

Vast Geography and Complex Logistics

Brazil's immense size and diverse geography present formidable logistical obstacles. Reaching potential tower sites in remote areas, such as the Amazon basin, the Pantanal wetlands, or mountainous regions, can be incredibly difficult and expensive. Existing road infrastructure may be poor or non-existent, requiring the use of boats, helicopters, or specialized off-road vehicles to transport personnel, equipment, and heavy construction materials (steel, concrete, fuel).

Weather patterns, including heavy rainfall in tropical regions, can halt construction activities for extended periods. Managing supply chains across such vast distances requires meticulous planning and robust logistical capabilities. These geographical challenges significantly increase the cost and complexity of building towers outside of major urban corridors.

Fragmented and Complex Regulatory Environment

Navigating Brazil's multi-layered and often inconsistent regulatory landscape is a major source of delays and frustration for tower builders. While ANATEL provides federal oversight, the crucial permits for land use and construction are typically issued by individual municipalities (over 5,500 of them).

Each municipality may have its own specific zoning ordinances, aesthetic requirements, fee structures, and application processes. Environmental licensing adds another layer of complexity, involving state or federal agencies depending on the location and potential impact.

This lack of standardization across jurisdictions means that securing all necessary permits for a single tower site can be a lengthy, bureaucratic, and unpredictable process, sometimes taking many months or even years. Efforts are underway to streamline permitting (e.g., through federal antenna laws), but practical implementation remains inconsistent.

High Costs and Financing Hurdles

Building communication towers requires substantial upfront capital investment. Costs include land acquisition/leasing, permitting fees, materials (steel prices can be volatile), labor, equipment rental, and transportation. Financing large-scale build programs, often involving hundreds or thousands of towers, requires access to significant capital markets or private equity funding.

Economic factors add further complexity. Brazil has experienced periods of high inflation and interest rates, increasing the cost of borrowing. Foreign exchange volatility poses a risk, particularly as key components like radio equipment are often imported and priced in US dollars. A depreciation of the Brazilian Real can significantly inflate project costs, requiring careful financial planning and hedging strategies by TowerCos and operators.

Ensuring Reliable Power Supply

Providing consistent and cost-effective electrical power to tower sites remains a significant operational challenge, impacting both construction and long-term viability. While Brazil's electrical grid is generally extensive in populated areas, reliability can vary, and many rural or remote locations lack grid access altogether. Historically, diesel generators have been the default solution for off-grid or unreliable-grid sites. However, diesel fuel is expensive, subject to price volatility, requires complex refueling logistics (especially for remote sites), and poses environmental concerns (noise, emissions).

Generators also require frequent maintenance. The industry is increasingly shifting towards more sustainable and cost-effective hybrid power solutions, combining solar panels, high-capacity batteries, and intelligent controllers, often retaining a smaller generator for backup. While greener, these solutions require higher initial investment and specialized maintenance skills, adding another layer to the construction planning process.

Brazil's Construction in Global Context

Brazil's experience with tower construction is part of a wider global narrative of . Comparing Brazil to other major markets helps contextualize its specific challenges and strategic approaches.

Scale vs. Urban Density

Brazil's primary infrastructure challenge mirrors that of other geographically vast nations: achieving widespread coverage across immense territory. This emphasis on scale contrasts sharply with the primary focus in dense global cities. For instance, the strategy driving is almost entirely about deploying thousands of small cells on existing street furniture to saturate a relatively small, vertical area with extreme capacity. Similarly, building a often involves sophisticated stealth designs and complex in-building solutions tailored for a futuristic cityscape.

Brazil, however, must pursue a dual strategy: deploying advanced solutions for capacity in its megacities like São Paulo and Rio de Janeiro, while simultaneously undertaking extensive macro tower construction to extend basic coverage across its continental landmass.

Logistical Parallels and Differences

The daunting logistical challenges of communication tower construction in Brazil, particularly in the Amazon, find echoes in other geographically complex regions. The intricate process of , requiring coordination across thousands of islands often involving maritime transport, highlights how unique geographies shape construction methodologies. While both face severe logistical hurdles, Brazil's are predominantly land-based (navigating rivers, rainforests, poor roads), whereas Indonesia's involve inter-island sea transport. Both demand exceptional project management and supply chain resilience.

Growth Drivers: Mandates vs. Organic Demand

While Brazil experiences strong organic growth in data demand, the current surge in tower construction is significantly amplified by ANATEL's mandatory 5G coverage targets linked to spectrum licenses. This regulatory imperative provides a distinct momentum. This contrasts somewhat with markets like India, where the sheer scale of demand for basic connectivity and affordable data drives the massive need for perhaps more organically, although regulatory pushes also exist.

Likewise, the demand for a , fueled by Africa's largest population and a deeply entrenched mobile-first economy, has a strong organic component alongside government broadband plans. Brazil's regulatory framework serves as a powerful accelerator for its current build cycle.

Market Maturity and TowerCo Dominance

Brazil stands out for its relatively mature and highly consolidated independent TowerCo market. Large, well-capitalized international players dominate the landscape, having acquired most operator assets. This structure facilitates large-scale, efficient infrastructure deployment. This is more advanced compared to markets still undergoing this transition, such as Egypt, where identifying a suitable is part of an evolving ecosystem moving away from operator-centric models. Brazil's established TowerCo dominance streamlines investment and construction processes.

Operational Considerations Across Regions

Although this article focuses on construction, the long-term operational viability, heavily dependent on maintenance, is implicitly linked. The challenges faced in Brazil (remote site access, power reliability) will require robust, ongoing maintenance strategies. These can be informed by best practices observed globally. For example, the rigorous approach to must contend with extreme heat, sand, and dust, requiring specialized techniques.

Similarly, ensuring network reliability in a critical hub like Nairobi involves specific strategies for , addressing issues like security and urban logistics. Learning from these diverse operational environments, including understanding the capabilities needed from a , can inform sustainable construction and operational planning in Brazil. All these infrastructure efforts are crucial components of broader national and strategies, enabling digital participation and economic growth.

Technology Adoption Pace

Brazil's commitment to a rapid and widespread 5G rollout places it among the leading nations in technology adoption within emerging markets. This ambition is shared by countries like Kenya, where the push for a is central to its vision of becoming a regional digital leader ('Silicon Savannah'). Brazil's large-scale construction efforts ensure it remains a significant player in the global deployment of next-generation wireless technologies.

Future Trends in Brazilian Tower Construction

The landscape of communication tower construction in Brazil is dynamic and will continue to evolve in response to technological advancements, market demands, and shifting economic conditions. Several key trends are expected to shape the industry's trajectory in the coming years.

Ongoing Urban Densification

While the initial phase of 5G deployment often leverages existing macro tower grids with upgraded equipment, achieving the full potential of 5G (especially ultra-low latency and multi-gigabit speeds) requires significant network densification, particularly in major cities.

Consequently, future construction efforts will increasingly focus on deploying smaller infrastructure elements. This includes installing antennas on rooftops, integrating small cells onto existing street furniture (lampposts, utility poles), and potentially building new, dedicated small cell structures. This shift demands different site acquisition strategies, closer collaboration with municipal authorities for aesthetic integration, and construction techniques adapted for dense urban environments.

Tower Fiberization Becomes Standard

The performance of a 5G cell site is critically dependent on the quality and capacity of its backhaul connection to the core network. Fiber optic cable offers the necessary high bandwidth and low latency. While microwave links remain viable in some scenarios, fiber is becoming the preferred backhaul solution, especially for 5G. This trend means that communication tower construction in Brazil will become increasingly intertwined with fiber optic network deployment. New tower builds are likely to incorporate fiber connectivity requirements from the outset. Furthermore, significant construction activity will be generated by projects aimed at retrofitting existing towers, replacing legacy microwave or copper connections with high-capacity fiber links (Fiber-to-the-Tower or FTTT). TowerCos and dedicated fiber infrastructure companies are forming partnerships to facilitate this crucial upgrade.

Integration of Green Energy Solutions

Sustainability and operational efficiency are driving a definitive shift towards green energy solutions for powering tower sites. The high cost and logistical challenges associated with diesel generators, particularly for remote sites, make renewable energy increasingly attractive.

Future communication tower construction projects will more frequently incorporate integrated green power systems as standard design elements. This includes optimizing site layouts for solar panel installation, deploying advanced battery storage technologies (like lithium-ion), and utilizing intelligent hybrid power controllers.

This trend not only reduces long-term operational expenditures (OPEX) and improves network reliability (by mitigating fuel supply risks) but also aligns with corporate environmental, social, and governance (ESG) goals and Brazil's national climate commitments. Construction planning will need to account for the installation and integration of these power systems.

Continued Focus on Rural Expansion

Despite the focus on urban 5G, extending basic mobile broadband coverage to Brazil's vast rural and remote areas remains a critical objective for both the government and operators (partly due to coverage obligations). Communication tower construction will continue in these underserved regions, driven by universal service programs and the need to connect agricultural zones, small towns, and remote communities.

Innovation in low-cost tower designs (e.g., lighter structures, simplified foundations) and power solutions optimized for off-grid deployment will be crucial for making rural expansion economically viable. Exploring alternative backhaul technologies, such as next-generation satellite systems (LEO/MEO), might also influence site selection and construction priorities in the most isolated areas.

Conclusion

Communication tower construction in Brazil is more than just erecting steel structures; it is the fundamental process of laying the physical groundwork for the nation's digital society and economy. This complex undertaking, driven by the imperatives of 5G deployment, insatiable data demand, strategic industry restructuring, and national digital inclusion goals, is reshaping Brazil's connectivity landscape at an unprecedented pace. The major TowerCos, in partnership with MNOs and specialized construction firms, are navigating a challenging environment marked by immense geographical scale, intricate regulations, significant costs, and operational hurdles like power provision.

By employing innovative solutions, embracing efficient business models like infrastructure sharing, and increasingly integrating sustainable practices, the industry is overcoming these obstacles. The ongoing construction efforts, encompassing everything from massive rural macro towers to discreet urban small cells, ensure that Brazil can harness the transformative potential of next-generation wireless technologies, fostering economic growth, enabling innovation, and connecting its diverse population for decades to come.

Hey, I’m Chunjian Shu

"X.Y. Tower: Reliable, innovative solutions for high-quality towers and electrical equipment with professional service.