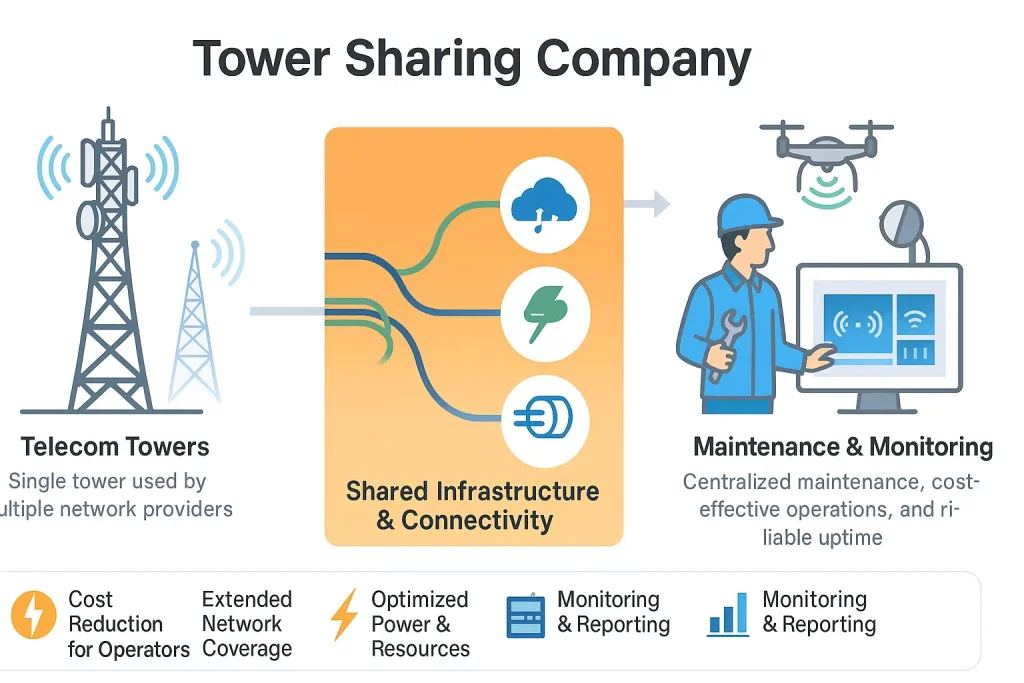

How Tower Sharing Companies Are Reducing Network Costs

2025-10-25

A tower sharing company plays a crucial role in the telecommunications ecosystem by significantly reducing network deployment and operational costs for mobile network operators (MNOs). These specialized firms own, manage, and lease passive infrastructure, primarily Telecommunications Tower structures, allowing multiple operators to co-locate their equipment on shared sites. This model drives substantial efficiencies. It lowers capital expenditure, reduces operating expenses, and accelerates network rollouts.

This definitive guide provides an expert explanation of how these companies operate. It details the specific mechanisms through which they deliver cost savings and enhance network efficiency. Understanding this model is key to appreciating the economics of modern wireless communication.

What is a Tower Sharing Company?

A tower sharing company, often called a TowerCo, is a specialized entity that owns, builds, manages, and leases passive telecommunications infrastructure (towers, sites, power) to multiple mobile network operators (MNOs) or other wireless service providers.

These companies focus exclusively on the physical "passive" layer of the network – the steel structures, the land they sit on, the power systems, and the equipment shelters. They do not typically own or operate the "active" electronic equipment (antennas, radios) that transmits signals; that remains the responsibility of the MNO tenants. By serving multiple tenants on each tower (co-location), TowerCos create significant efficiencies compared to a model where each operator builds and maintains its own separate tower network. They are essential telecom infrastructure providers.

How Does the Tower Sharing Model Work?

The model involves a TowerCo investing capital to build or acquire towers and related site infrastructure. They then lease vertical space and ground space at these sites to MNOs under long-term agreements, allowing operators to install their antennas and equipment.

The TowerCo acts as a neutral landlord. They provide the secure, powered, and structurally sound platform. The MNO tenants install their own proprietary active equipment (antennas, baseband units, radios) onto the leased space. The TowerCo is responsible for the ongoing maintenance and operational integrity of the passive infrastructure. This includes ensuring structural safety, site access, power availability, and compliance with regulations. This multi-tenant approach maximizes the utilization of each tower asset.

What is the Primary Role of These Companies?

The primary role is to provide scalable, reliable, and cost-effective passive infrastructure solutions, enabling MNOs to expand network coverage and capacity more efficiently. They manage the entire lifecycle, from site development and installation to ongoing operations and maintenance.

TowerCos handle the complex and capital-intensive tasks associated with physical infrastructure. This includes site acquisition, navigating zoning and permitting, overseeing tower installation service, and managing long-term upkeep. By specializing in these activities, they achieve economies of scale and operational expertise that individual MNOs often cannot match. Their core function is to be expert managers of passive telecom assets, providing a critical service platform for the wireless industry.

How Do They Differ from Traditional Network Operators?

TowerCos differ fundamentally in their business focus: they own and manage passive physical assets, generating revenue through leasing. Traditional MNOs focus on acquiring spectrum, deploying active network equipment, and delivering communication services to end-users, generating revenue through subscriptions.

The TowerCo model represents a structural separation within the industry. MNOs are primarily service companies focused on network performance, spectrum efficiency, and customer relationships. TowerCos are infrastructure companies focused on real estate management, structural engineering, and operational uptime of physical sites. While some MNOs still own towers, the global trend is towards operators divesting their tower portfolios to specialized TowerCos. This allows each type of company to focus on its core competencies. This trend is visible globally, impacting MNO strategies everywhere.

How Does Tower Sharing Directly Reduce Network Operator CAPEX?

Tower sharing offers one of its most significant benefits by directly and substantially reducing the capital expenditure (CAPEX) required for network operators to build and expand their networks. Building towers is incredibly expensive, and sharing this infrastructure avoids massive upfront investments.

Why Avoid the High Cost of Building New Towers?

Building new towers involves enormous costs for site acquisition (leasing or buying land), zoning/permitting fees, engineering, materials (steel, concrete), construction labor, and project management. Avoiding these substantial upfront investments frees up operator capital for other critical areas.

The cost to build a single new macro tower can easily run into hundreds of thousands of dollars, varying greatly depending on location, height, and complexity. Key cost components include:

- Site Acquisition: Negotiating long-term land leases or purchasing property.

- Regulatory Approvals: Fees and professional services for zoning applications, environmental studies, and building permits.

- Engineering: Structural design, foundation engineering based on soil analysis.

- Materials: Significant costs for steel (tower structure) and concrete (foundation).

- Construction: Labor for foundation work, tower erection (often requiring cranes and specialized crews), and site preparation (access roads, fencing). By leasing space on an existing tower from a tower sharing company, MNOs bypass these significant capital outlays entirely for that specific site. The aggregate savings across a large network buildout are immense.

How Does Leasing Shift Costs from CAPEX to OPEX?

Leasing tower space shifts the financial burden from large, irregular capital expenditures (CAPEX) for building to predictable, recurring operating expenses (OPEX) in the form of monthly or annual lease payments. This improves operator cash flow and financial flexibility.

Instead of investing millions upfront to build towers, operators pay a regular lease fee to the TowerCo. This OPEX model offers several financial advantages:

- Predictability: Lease payments are known, recurring costs, making financial planning easier.

- Improved Cash Flow: Avoids tying up large amounts of capital in fixed assets.

- Faster Deployment: Capital can be deployed more quickly towards revenue-generating active equipment rather than slow-build infrastructure.

- Balance Sheet Management: Reduces the asset intensity on the operator's balance sheet (attractive to investors). This shift is a key strategic financial benefit driving the adoption of the tower sharing model. The financial advantages are a major topic in telecom industry analyses.

What Are the Economies of Scale Involved?

TowerCos achieve significant economies of scale by building and managing thousands of towers. They benefit from bulk purchasing of materials, standardized designs, efficient construction processes, and centralized operations, leading to lower per-tower costs compared to an operator building independently.

Scale is a crucial advantage for a telecom infrastructure provider.

- Bulk Procurement: Purchasing steel, concrete, generators, and other equipment in large volumes yields lower unit costs.

- Standardization: Using standardized tower designs and construction methods across their portfolio streamlines engineering and installation.

- Specialized Crews: Employing or contracting highly efficient, specialized crews for installation and maintenance optimizes labor costs.

- Centralized Management: Managing site acquisition, permitting, monitoring, and maintenance centrally reduces overhead. These economies of scale allow TowerCos to build and operate towers more cost-effectively than a single MNO could, passing some of these savings on through competitive lease rates.

How Does Shared Infrastructure Lower Operational Expenses (OPEX)?

Beyond avoiding the CAPEX of building, sharing infrastructure managed by a tower sharing company also leads to significant reductions in ongoing operational expenses (OPEX) for network operators. Costs associated with land, power, and maintenance are effectively shared among multiple tenants.

How Are Site Maintenance Costs Shared Among Tenants?

Routine site maintenance costs, such as groundskeeping, structural inspections, lighting upkeep, and site security, are managed by the TowerCo and the cost is implicitly shared among all tenants through their lease payments. Operators avoid the burden of managing individual site upkeep.

Maintaining a tower site involves numerous recurring tasks. These include mowing grass, ensuring fences are secure, performing periodic structural checks by a tower maintenance company, and ensuring regulatory compliance (like FAA lighting). In a shared model, the TowerCo handles all this passive infrastructure maintenance. The cost is factored into the overall lease rate, effectively distributing the expense across all operators using the site. This is far more efficient than each operator managing maintenance independently for their own (hypothetical) separate tower at the same location.

What is the Impact on Land Lease and Rental Expenses?

Tower sharing drastically reduces land lease expenses for operators. Instead of each operator needing to secure and pay for its own ground lease, multiple operators share a single site managed under one lease agreement held by the TowerCo.

Land costs, especially in desirable urban or suburban locations, can be a significant recurring expense. If three operators each built their own tower in close proximity, they would each need to negotiate and pay for a separate ground lease. With tower sharing, only one ground lease is required for the shared site, held by the TowerCo. The MNO tenants pay their tower lease fee, which includes the underlying land cost component, but this shared cost is invariably lower than securing individual land parcels. This consolidation yields major savings.

How Does Shared Power and Backup Reduce Energy Costs?

Shared power infrastructure, including the grid connection, metering, and backup systems (generators, batteries), allows tenants to share the significant costs associated with powering a cell site. TowerCos often negotiate favorable electricity rates and invest in efficient backup solutions.

Powering the active equipment at a cell site is a major operational expense. A shared site typically uses a single connection to the electrical grid and a shared backup power system.

- Shared Grid Connection: The infrastructure cost of bringing power to the site is shared.

- Bulk Energy Rates: TowerCos, managing thousands of sites, may be able to negotiate better electricity rates than individual operators.

- Shared Backup Systems: The substantial cost of purchasing, installing, and maintaining large generators and battery banks is shared among tenants. TowerCos often invest in high-efficiency backup systems. This sharing model significantly reduces the per-operator cost of ensuring reliable power, a critical factor for network uptime. Energy efficiency is a growing focus for TowerCos.

What Are the Efficiencies Gained in Site Monitoring and Security?

Centralized remote monitoring of site status (power, access, environmental conditions) and security systems by the TowerCo provides efficiency gains. Operators benefit from professional oversight without needing to implement and manage individual monitoring for each leased site.

Leading TowerCos utilize sophisticated Network Operations Centers (NOCs) to remotely monitor their entire portfolio. They track power status, generator fuel levels, site temperature, and intrusion alarms. This centralized approach is far more efficient than each MNO monitoring its own equipment on thousands of individually managed sites. Shared security measures, such as fencing and access control systems managed by the TowerCo, also reduce the security burden and cost for each tenant.

What Role Does Tower Sharing Play in Accelerating Network Deployment?

A tower sharing company plays a critical role in accelerating the deployment of new networks and the expansion of existing ones. By providing readily available infrastructure and leveraging specialized expertise, they enable MNOs to get their services to market much faster than would be possible if building independently.

How Does Access to Existing Towers Speed Up Rollouts?

Accessing existing towers dramatically speeds up rollouts by bypassing the lengthy process of new site development. Operators can often install equipment on a pre-approved, existing structure within weeks or months, compared to the 12-24+ months typically required to build a new tower.

The single biggest accelerator is the availability of existing structures. The timeline for building a new tower is fraught with potential delays:

- Site identification and negotiation (months).

- Zoning and permitting approvals (can take 6 months to over a year, with potential community opposition).

- Foundation construction and curing (weeks to months).

- Tower erection (days to weeks). By finding a suitable existing tower owned by a TowerCo, operators skip most of these steps. They submit a co-location application, the TowerCo performs a structural analysis, lease terms are finalized, and installation can proceed relatively quickly. This speed-to-market advantage is crucial in the highly competitive telecom industry. This efficiency is a core part of comprehensive telecom tower services.

How Do TowerCos Streamline Site Acquisition and Permitting?

Even when new builds are necessary, TowerCos streamline the process through their specialized expertise. They have dedicated teams experienced in navigating local real estate markets, zoning regulations, and permitting requirements, significantly reducing lead times compared to MNOs managing this in-house.

TowerCos are experts in site development. Their teams possess deep knowledge of:

- Real Estate: Identifying suitable parcels and negotiating favorable lease terms.

- Zoning & Permitting: Understanding local ordinances, preparing thorough applications, and presenting effectively at public hearings. Relationships with local authorities are key.

- Environmental Compliance: Conducting necessary environmental assessments (e.g., NEPA reviews). This specialized focus allows them to manage the complex and often bureaucratic approval processes much more efficiently than a typical MNO, whose primary focus is network technology. This expertise is critical in diverse regulatory environments, whether for cell site installation in the UAE or elsewhere.

What is the Benefit for Entering New Geographical Markets?

For MNOs entering new geographical markets, partnering with a TowerCo that already has an established footprint in that region provides an immediate infrastructure platform. This drastically lowers the initial investment and time required to launch services.

Entering a new region typically requires building a substantial number of new towers – a massive undertaking. If a TowerCo already owns hundreds or thousands of towers covering that market, the new entrant can immediately lease space on those existing structures. This allows them to achieve significant coverage quickly and with far less upfront capital risk compared to building from scratch. This model lowers the barrier to entry, fosters competition, and accelerates the availability of wireless services. This applies whether expanding within a country or entering new territories like those requiring specific telecom tower service in Mexico.

How Does Tower Sharing Enhance Network Efficiency and Coverage?

Beyond cost savings and speed, the tower sharing company model also contributes to overall network efficiency and the ability to extend coverage, particularly with the demands of new technologies like 5G. Shared infrastructure facilitates denser networks and makes deployment in challenging areas more viable.

How Does it Enable Faster Network Densification (e.g., for 5G)?

Tower sharing enables faster densification by providing readily available macro sites for upgrades and a platform for deploying small cells. TowerCos often have master lease agreements for potential small cell locations (like utility poles), simplifying the process for operators needing to add capacity.

5G requires networks to be much denser than previous generations, especially in urban areas. This means adding more equipment to existing macro towers and deploying thousands of small cells. TowerCos support this by:

- Facilitating Macro Upgrades: Streamlining the process for tenants to add heavier 5G antennas to existing shared towers (subject to structural capacity).

- Providing Small Cell Platforms: Proactively securing rights to use street furniture and offering standardized mounting solutions for small cell equipment. This availability of diverse infrastructure options allows MNOs to densify their networks more quickly and cost-effectively to meet 5G capacity demands. The infrastructure needs for 5G are driving significant growth in the TowerCo sector.

Can Sharing Improve Coverage in Underserved Areas?

Yes, the tower sharing model can improve coverage in underserved rural or remote areas. A TowerCo may find it economically viable to build a tower in such an area if they can secure multiple MNO tenants, whereas a single MNO might not justify the investment alone.

Building towers in remote locations is often very expensive due to logistical challenges and potentially lower subscriber density. It may not make financial sense for a single operator to build a dedicated tower. However, if a TowerCo can secure commitments from two or three operators to lease space on a proposed tower, the shared revenue stream makes the investment viable. This allows networks to expand into areas that might otherwise remain unserved, helping to bridge the digital divide. Government initiatives often encourage infrastructure sharing to promote rural connectivity.

How is Co-location Managed to Prevent Interference?

Co-location is managed through careful radio frequency (RF) engineering and planning. TowerCos work with tenants to ensure antennas are spaced appropriately (vertically and horizontally) and oriented correctly to minimize signal interference between different operators' equipment.

When multiple operators transmit signals from the same tower, there is a potential for interference. TowerCos manage this through:

- RF Analysis: Performing studies to model potential interference before new equipment is installed.

- Antenna Placement Guidelines: Following industry best practices for physical separation of antennas based on frequency bands and power levels.

- Intermodulation Studies (PIM): Testing to identify and mitigate passive intermodulation, a type of interference caused by non-linearities in passive components.

- Coordination: Facilitating communication and coordination between tenants regarding frequency use and equipment changes. Proper management ensures that the benefits of sharing are realized without degrading individual network performance.

What Are the Broader Economic and Environmental Benefits?

The impact of the tower sharing company model extends beyond the direct benefits to network operators. It generates broader economic advantages by fostering competition and efficiency. It also yields significant environmental benefits by reducing the overall number of towers required.

How Does it Reduce the Overall Number of Towers Needed?

By enabling multiple operators to co-locate on a single structure, tower sharing significantly reduces the total number of towers needed to provide widespread coverage. This minimizes the visual impact on landscapes and conserves land resources.

Imagine a scenario without sharing: each of the major MNOs might build its own separate tower in roughly the same location to achieve coverage. With sharing, one tower serves all of them. This consolidation dramatically reduces the proliferation of towers, particularly in dense areas. This is a significant environmental and aesthetic benefit, often strongly favored by local planning authorities and communities. Reducing the number of towers also conserves the materials (steel, concrete) and energy required for their construction.

How Does it Foster Competition Among Network Operators?

Tower sharing fosters competition by lowering the infrastructure cost barrier for existing operators and potential new entrants. Reduced network build-out costs allow operators to compete more aggressively on service pricing and innovation.

When operators can deploy networks more affordably by leasing shared infrastructure, it becomes easier for smaller players or new entrants (like MVNOs) to compete with established incumbents. Lower infrastructure costs can translate into lower service prices for consumers. It also allows operators to invest more in service quality and innovative offerings rather than duplicating physical infrastructure. This competitive dynamic ultimately benefits consumers.

What is the Impact on Resource Optimization (Land, Materials)?

The model leads to significant resource optimization. Fewer towers mean less land is required for site leases. Less steel and concrete are consumed in construction. Shared power systems can lead to more efficient energy consumption per operator.

Consolidating multiple networks onto fewer physical sites is inherently more resource-efficient. It minimizes the cumulative demand for land, construction materials, and operational resources like power and fuel for backup generators. This efficient use of assets aligns with broader goals of sustainability and responsible resource management. The environmental benefits of infrastructure sharing are increasingly recognized.

Conclusion

The tower sharing company model has fundamentally reshaped the telecommunications landscape, providing an efficient and scalable backbone for modern wireless networks. By specializing in the ownership, development, and management of passive infrastructure, these providers deliver substantial cost savings to network operators through reduced CAPEX and OPEX. They accelerate network deployment, enhance operational reliability, and enable the densification required for technologies like 5G. Beyond these direct benefits, tower sharing fosters competition and offers significant environmental advantages by optimizing resource use. As connectivity demands continue to surge globally, the role of the expert telecom infrastructure provider as a key enabler of cost-effective, reliable, and rapidly deployable networks is more critical than ever.

Hey, I’m Chunjian Shu

"X.Y. Tower: Reliable, innovative solutions for high-quality towers and electrical equipment with professional service.