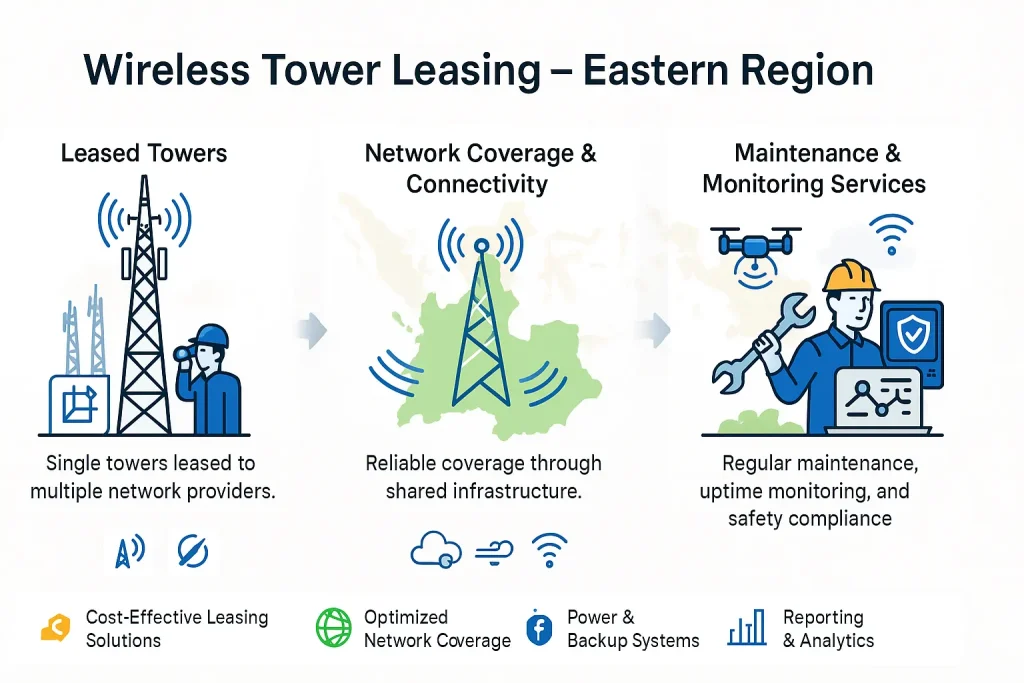

Wireless Tower Leasing Solutions in Eastern Regions

2025-10-25

Wireless tower leasing solutions are the primary financial and operational strategy for modern network expansion. This model allows mobile network operators (MNOs) to rapidly deploy their services. They do this without the immense capital expenditure of building their own towers. Instead, they lease space on existing structures. These structures are owned by independent infrastructure companies. This approach is fundamental to the telecom industry. It promotes faster rollouts, greater efficiency, and better resource allocation. As data demands surge, wireless tower leasing is the engine that powers connectivity.

The Fundamentals of Wireless Tower Leasing

Wireless tower leasing is the commercial agreement that underpins modern telecommunications. It is a specialized real estate transaction. This transaction allows a network operator to place its antennas and equipment on a tower. This tower is owned by another entity.

What is Wireless Tower Leasing?

Wireless tower leasing is a contractual arrangement. A property owner (the lessor) grants a telecom company (the lessee) the right to use a portion of their tower. This also includes a small parcel of land at its base. In exchange, the lessee pays regular rent. This model applies to MNOs leasing from a Tower Company (TowerCo). It also applies to landowners leasing their land to a TowerCo. For network operators, leasing is a core strategy. It provides access to vital vertical infrastructure.

The Evolution from Operator-Owned to Independent Models

The telecom industry has seen a major structural shift. In the early days of mobile networks, operators built, owned, and maintained their own tower portfolios. This was a capital-intensive model. It tied up billions in passive infrastructure. Over the past two decades, a new model emerged. Operators began selling their tower assets to independent TowerCos. These new companies specialize in managing infrastructure. This shift unlocked capital for MNOs. It also created a new, efficient market focused on shared infrastructure.

Key Players: Tower Companies and MNOs

The leasing market is defined by two main players. Mobile Network Operators (MNOs) are the tenants. They are the brands that provide mobile voice and data services to the public. They need to place antennas in specific locations to create their network. Tower Companies (TowerCos) are the landlords. They are the independent owners and operators of the physical towers. Their business model is not selling mobile service. Their model is leasing vertical space to as many tenants as possible.

The Core Value Proposition for Tenants

The value proposition of wireless tower leasing for an MNO is compelling. The primary benefit is speed-to-market. Leasing an existing tower is significantly faster than acquiring land and building a new one. The second benefit is capital preservation. Operators can convert heavy capital expenditures (CapEx) into predictable operational expenditures (OpEx). This frees up capital. MNOs can then invest this capital in spectrum, marketing, and core network technology. This strategic focus is a key competitive advantage.

The Strategic Benefits of Leasing for Network Operators

For a modern Mobile Network Operator, leasing is not just a convenience. It is a critical component of their financial and operational strategy. The benefits directly impact their competitiveness.

Accelerating Time-to-Market

The race to deploy new services, especially 5G, is intense. Building a new tower is a slow process. It involves finding a suitable site, negotiating with landowners, and navigating complex zoning and permitting laws. This can take months or even years. Wireless tower leasing bypasses this entire process. An MNO can identify a suitable existing tower. They can sign a lease and install their equipment in a matter of weeks. This speed is a decisive factor in launching services before competitors.

Financial Agility: Shifting CapEx to OpEx

The financial model of leasing is highly attractive. Building a tower portfolio requires massive upfront capital investment. This is money that is locked into steel and concrete. By leasing, MNOs change their financial structure. They avoid the large CapEx hit. Instead, they pay a predictable monthly or annual lease fee. This is an operational expenditure (OpEx). This OpEx model smooths out budgets. It also improves key financial metrics. It allows for more flexible scaling; operators pay for what they need, when they need it.

Reducing Operational Complexity

Managing a portfolio of thousands of towers is a complex business. It involves land management, structural engineering, regulatory compliance, and site maintenance. This is a significant operational distraction. It is far removed from an MNO's core business of managing a spectrum and customers. Leasing outsources this complexity. The TowerCo handles all aspects of physical asset management. The MNO can then focus all its resources on its primary mission: delivering high-quality, reliable mobile services.

Focusing on Core Business and Services

The strategic separation of infrastructure from services is efficient. MNOs are experts in radio frequency engineering, network management, and customer service. TowerCos are experts in real estate, construction, and infrastructure maintenance. Wireless tower leasing allows each party to focus on its core competency. MNOs are freed from the burden of being landlords. They can dedicate their engineering talent and capital to what truly differentiates them. This includes their 5G core network, service quality, and customer experience.

The Tower Owner Perspective: A Business Model Built on Sharing

The independent TowerCo model has been highly successful. It is built on the simple, powerful economics of infrastructure sharing.

The Role of the Independent Tower Company

An independent TowerCo is a specialized infrastructure real estate company. Their primary assets are vertical structures. These include monopoles, lattice towers, and guyed towers. Their business is to acquire, build, and operate these towers. They then market the space on these towers to tenants. Their success is not tied to one MNO. It is tied to the overall growth of the wireless industry. They provide a neutral, available-platform for all carriers.

Maximizing Asset Utilization and ROI

A tower built for a single MNO is an underutilized asset. Most of the tower's structural capacity is unused. The TowerCo's business model is to maximize asset utilization. They aim to lease space to multiple tenants on a single tower. The first tenant on a tower (the "anchor tenant") covers the base cost. Every subsequent tenant (a "co-location") adds almost pure profit. This multi-tenant model dramatically increases the return on investment (ROI) for each asset.

The Economics of Co-location

Co-location is the practice of multiple tenants sharing one tower. This is the economic engine of the TowerCo model. The cost to add a second or third tenant is minimal. It requires some structural analysis and minor reinforcement. Yet, this new tenant pays a significant lease rate. This drives high-profit margins for the TowerCo. This efficiency is also passed on to the MNOs. A co-location lease is almost always cheaper for an MNO than building their own new tower.

How a Operates

A tower sharing company is synonymous with a TowerCo. They operate by building a large, geographically diverse portfolio of towers. Their sales teams have deep relationships with all the major MNOs. Their engineering teams manage the structural capacity of each tower. Their legal and real estate teams manage the underlying ground leases. They are proactive asset managers. They identify new areas for tower construction. They also actively market their available space to all potential tenants. This model fosters a healthy, competitive ecosystem for connectivity.

Navigating the Wireless Tower Lease Agreement

The lease agreement is the central legal document in this transaction. It is a complex, long-term contract. It defines the rights and responsibilities of both the lessor and lessee.

Key Components of the Lease Contract

A typical wireless tower lease includes several key components. It will define the Leased Premises. This includes the specific vertical space on the tower. It also includes the ground space for equipment shelters or cabinets. The Term of the lease is often long. It usually has an initial term of 5-10 years. It also includes multiple renewal options. The Rent section details the base payment. It also defines how the rent will increase over time. Other key clauses cover access, insurance, maintenance, and default.

Understanding Master Lease Agreements (MLAs)

MNOs that lease hundreds or thousands of sites from a single TowerCo do not negotiate each lease individually. Instead, they negotiate a Master Lease Agreement (MLA). This master contract sets the standard legal and business terms for all transactions. When the MNO wants to lease a new site, they use a simple "site lease agreement." This new agreement incorporates all the terms of the MLA. This system dramatically simplifies and accelerates the leasing process for large-scale deployments.

Defining Lease Rates and Escalators

Lease rates are determined by several factors. These include the tower's location, height, and structural capacity. The amount of space the tenant needs also affects the rate. Rates in dense urban areas are much higher than in rural ones. The lease will also contain an escalator clause. This clause defines how the rent will increase each year. This is often a fixed percentage. It can also be tied to an inflation index. This clause is one of the most important financial terms in the contract.

Terms for Amendments and Technology Upgrades

A lease must be a living document. Technology changes rapidly. A tenant may need to add new antennas. They may need to swap 4G equipment for 5G. The lease must have clear amendment terms. These terms define the process for making changes. They specify how new equipment will be approved. They also detail how the rent will be adjusted. A good lease agreement provides a clear, predictable path for future technology upgrades. This prevents drawn-out negotiations every time a new technology emerges.

The Leasing Process: From Site Selection to Activation

The process of leasing a tower site follows a structured timeline. It moves from initial network planning to a live, operational cell site.

Site Acquisition and Candidate Identification

The process begins with the MNO's network planners. They identify a "search ring." This is a geographic area that needs new or improved coverage. The MNO's real estate team, or a contractor, then identifies suitable towers within this ring. They will contact the TowerCos that own these assets. They will request information on available space and structural capacity. This is the site acquisition phase. The goal is to find a viable candidate that meets the MNO's RF objectives.

The Importance of Zoning and Permitting

Even for a co-location on an existing tower, permits are often required. The local municipality must approve the addition of new antennas. This involves a zoning and permitting process. The TowerCo and the MNO work together on this. They must submit detailed plans and engineering reports. This process ensures the new installation is safe. It also ensures it complies with all local codes. While simpler than for a new tower, this step is critical and can take time.

The Phase

Once the lease is signed and permits are approved, the installation begins. The MNO hires a specialized contractor. This contractor performs the tower installation service. This involves a highly skilled crew of tower climbers. They ascend the tower to install the antenna mounts. They then hoist and attach the antennas and radio units. On the ground, other crews install the equipment shelter. They also run power and fiber optic cables. This is highly technical and dangerous work. It must be done to exact engineering specifications.

Finalizing Collocation and Going Live

After the physical installation, the site is not yet live. The MNO's technicians must test and commission the new equipment. This involves connecting the site to the MNO's core network. They perform extensive testing. They test the radio frequencies, data speeds, and call quality. Once all tests are passed, the site is "activated." It is integrated into the live network. At this point, it begins to carry customer traffic. The leasing process is now complete, and the site is operational.

How Leasing Accelerates 5G Deployment

The rollout of 5G presents unique challenges. These challenges make wireless tower leasing more important than ever. 5G is not just an upgrade; it is a new network architecture.

Meeting the Densification Demands of 5G

5G technology, especially on high-frequency spectrum, has a shorter range than 4G. To provide consistent 5G coverage, operators need many more cell sites. This is known as network densification. It is not feasible to build new towers for all these sites. The wireless tower leasing model is the only way to achieve this. MNOs must co-locate on as many existing structures as possible. This includes macro towers, rooftops, and water tanks.

The Role of Leasing in Small Cell Deployment

Densification also involves small cells. These are low-power, compact antennas. They are placed on streetlights, utility poles, and building facades. This is a new frontier for leasing. MNOs and TowerCos must now negotiate with municipalities. They also must work with utility companies. They need to secure "attachment rights" for these structures. This is a high-volume, complex leasing environment. It is essential for providing high-capacity 5G in dense urban areas.

Enabling Low-Latency Edge Computing

5G promises ultra-low latency. This is essential for applications like autonomous driving and remote surgery. To achieve this, data must be processed closer to the user. It cannot travel to a distant cloud. This requires edge computing. Small data centers are placed at the tower site. The base of a tower is the new "edge." TowerCos are now leasing ground space. They are leasing it not just for radio equipment, but for these new edge data centers.

Future-Proofing Assets for New 5G Spectrum

The 5G rollout is happening in phases across different spectrum bands. A tenant may install 5G equipment today. In two years, they may need to add new antennas for a different band. The lease agreement and the tower itself must be future-proof. The TowerCo must ensure its structures can handle these future loads. The lease must have clear terms for these upgrades. This partnership ensures the infrastructure can evolve as 5G technology matures.

The Role of a Full-Service Infrastructure Partner

The relationship between an MNO and a TowerCo is evolving. It is moving from a simple landlord-tenant transaction to a deeper partnership.

Beyond Simple Leasing: A Partnership Approach

MNOs are looking for more than just space on a tower. They are looking for a partner. They need a partner who can help them meet their aggressive deployment goals. A sophisticated TowerCo does not just wait for lease applications. They work proactively with MNOs. They help them plan their network rollouts. They identify suitable sites. They even build new towers in anticipation of future demand.

The Value of an Integrated

The most valuable partners are full-service companies. A true telecom infrastructure provider handles the entire lifecycle. They have capabilities in engineering, site acquisition, construction, and maintenance. When an MNO needs to expand, they can go to this one partner. This partner can find the site, acquire the land, and build the tower. They can then lease the completed asset back to the MNO. This "build-to-suit" model is a key part of the leasing ecosystem.

Offering End-to-End

A full-service provider offers a complete menu of telecom tower services. This includes the initial structural analysis. It includes the tower installation service. It also includes ongoing maintenance and upgrades. This integrated approach is highly efficient. The MNO has a single point of contact. This one partner is responsible for the entire physical asset. This simplifies project management. It also ensures consistent quality and safety standards.

Streamlining Multi-Site, Multi-Region Rollouts

For an operator deploying thousands of sites across a large territory, this partnership is vital. A large, well-capitalized telecom infrastructure provider has a wide geographic footprint. They have established relationships with local jurisdictions. They have pre-negotiated Master Lease Agreements. This allows them to streamline a complex, multi-region rollout. They can manage the permitting and construction for hundreds of sites simultaneously. This scale is something an MNO could not easily replicate on its own.

Long-Term Asset Management and Maintenance

A wireless tower lease is a long-term agreement. The lessor is responsible for maintaining the structural integrity and safety of the tower for all tenants.

The Lessor's Responsibility for Upkeep

The TowerCo is responsible for the long-term asset management of the tower. This is a core part of the service they provide. They are legally and contractually obligated to keep the tower in good repair. This includes ensuring it complies with all safety standards. This responsibility is critical. All tenants on the tower depend on its structural integrity. A failure of the structure would be catastrophic for all operators on the site.

The Critical Role of a

TowerCos execute this responsibility by hiring a professional tower maintenance company. Sometimes, this is an in-house division. Other times, it is a specialized third-party contractor. These companies perform all preventive and corrective maintenance. This includes regular inspections. It involves structural audits, corrosion control, and painting. They also maintain the site grounds, security fencing, and access roads. Their work is essential for preserving the asset's value. It also ensures the safety of all tenants.

Ensuring Structural Integrity for All Tenants

When a new tenant is added, the TowerCo must perform a structural analysis. This ensures the tower can safely handle the new equipment. If it cannot, the TowerCo must perform structural upgrades. This might involve adding steel bracing or strengthening the foundation. This continuous engineering management is vital. It protects the existing tenants. It also ensures the tower remains a viable asset for future leasing.

Managing Power, Security, and Site Access

The TowerCo's management duties also include the ground space. They are responsible for managing the site compound. They ensure all tenants have secure, 24/7 access to their equipment. They manage the power and fiber utility services coming to the site. In many cases, they provide and maintain the backup power systems. This management of shared site resources is a key part_of the value they provide to their tenants.

The Future of Wireless Tower Leasing

The wireless tower leasing market continues to evolve. New technologies and business models are shaping the future of shared infrastructure.

Evolving Business Models (e.g., Tower-as-a-Service)

The leasing model is becoming more sophisticated. Some TowerCos are moving toward a "Tower-as-a-Service" model. They are offering more than just space. They are providing active, powered equipment. They are managing shared radio units. This "neutral host" model is complex. It allows a venue, like a stadium, to be served by all carriers. The carriers just connect to the TowerCo's neutral host system.

The Impact of IoT and Private Networks

The growth of the Internet of Things (IoT) is creating new demand. IoT networks often need wide, low-power coverage. This creates new leasing opportunities on existing towers. Furthermore, private networks are emerging. Factories, ports, and mines are building their own private 5G networks. These private networks also need to lease tower space. This opens up a new customer segment for TowerCos beyond the traditional MNOs.

Neutral Host Infrastructure

The neutral host model is a key future trend. This is where a telecom infrastructure provider builds and manages the entire active network. This could be in a subway, airport, or dense urban canyon. MNOs then pay a fee to use this shared network. This is a form of active leasing. It is far more efficient than having three or four carriers build parallel networks. This model is expected to grow. It is a key solution for complex indoor and outdoor coverage.

The Role of Infrastructure in Smart Cities

Future smart cities will be built on a foundation of ubiquitous connectivity. This requires a dense mesh of sensors and antennas. The Telecommunications Tower infrastructure is the backbone of this. This includes macro towers, small cells, and rooftop sites. The leasing model will be essential. It will allow smart city applications to be deployed quickly and cost-effectively. TowerCos will be key partners for municipalities. They will help build this "network of networks."

Conclusion

Wireless tower leasing has evolved from a simple real estate transaction into the strategic cornerstone of the digital world. It is the financial and operational model that makes rapid network deployment possible. For MNOs, leasing provides speed, financial flexibility, and a sharp focus on their core business. For TowerCos, the shared infrastructure model creates a highly efficient and profitable business. This symbiotic relationship, managed by a full-service telecom infrastructure provider, is essential. It is what allows for the rapid rollout of 5G. It also builds the foundation for the connected technologies of the future.

Hey, I’m Chunjian Shu

"X.Y. Tower: Reliable, innovative solutions for high-quality towers and electrical equipment with professional service.