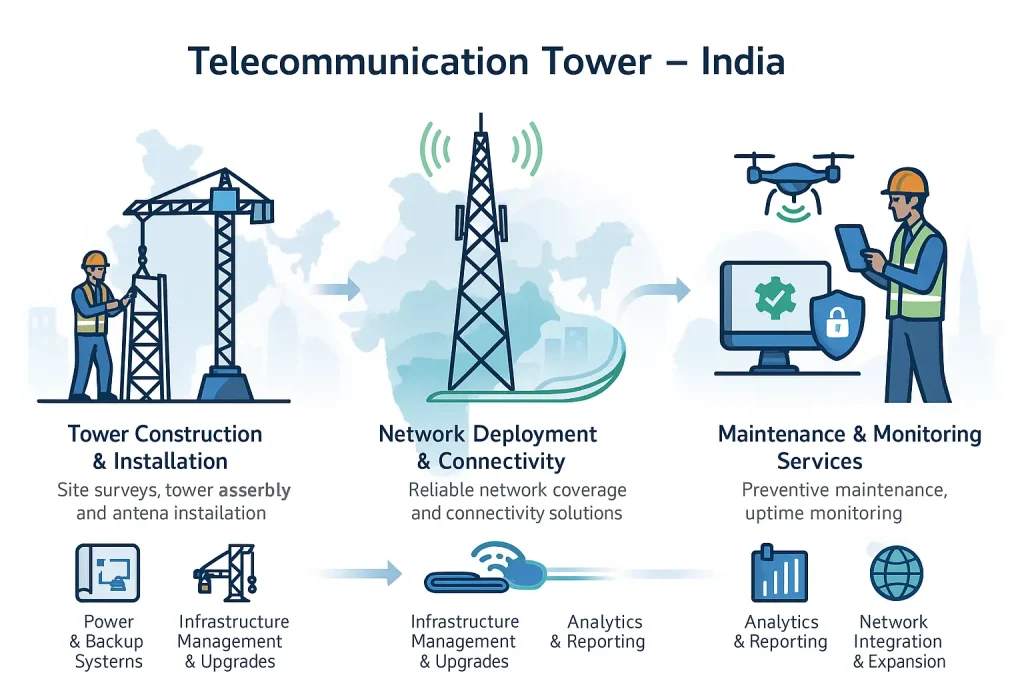

Telecommunication Towers in India: Growth & Opportunities

2025-10-25

Telecommunication towers in India form the backbone of a rapidly expanding digital economy. This infrastructure is essential for connecting over a billion people. As data consumption soars, the demand for more robust and widespread tower networks increases. This article explores the key growth drivers for India's telecom tower market. It details the massive 5G rollout, the challenge of rural connectivity, and the critical role of tower companies. Understanding these dynamics reveals significant opportunities.

Key Drivers for Telecom Tower Growth in India

The Indian telecom market is experiencing a massive surge in demand. This growth is not based on a single factor. It is the result of several powerful trends converging at the same time. These factors push the need for massive infrastructure investment.

The 5G Rollout and Network Densification

The nationwide 5G rollout is the single largest driver of growth. 5G technology requires a much denser network than 4G. This means operators must add new sites to ensure coverage and speed. India's 5G strategy has focused on standalone (SA) networks. This approach delivers true 5G capabilities. It also requires substantial investment in new tower and small cell locations. Operators are racing to deploy 5G services. This race creates a high demand for tower leasing and construction.

Soaring Mobile Data Consumption

India has one of the highest rates of mobile data consumption in the world. This is fueled by affordable data plans and widespread smartphone use. Users stream high-definition video, engage in online gaming, and use cloud-based services. This behavior places enormous strain on existing 4G networks. To manage this traffic, operators must expand capacity. This expansion is achieved by adding more equipment to existing towers. It also requires building new towers to handle the load.

Government Initiatives and Digital India

The Government of India is actively promoting digital connectivity. Initiatives like "Digital India" aim to transform the nation into a digitally empowered society. This vision relies on high-speed internet being available to all citizens. Government programs provide support for infrastructure development. This includes policies to streamline approvals. These efforts are designed to accelerate network expansion.

The Challenge of Rural Connectivity in India

Connecting rural India remains a significant challenge. This is also one of the market's biggest opportunities. A large portion of the population lives outside urban centers. These areas often lack reliable power and fiber backhaul.

The BharatNet Project

The BharatNet project is a key government initiative. Its goal is to provide broadband connectivity to all 250,000 Gram Panchayats (village councils). This project involves laying a massive optical fiber network. Telecom towers are the final link in this chain. They use this fiber backhaul to provide mobile broadband to remote villages. The success of BharatNet is directly tied to the availability of tower infrastructure.

Overcoming Infrastructural Hurdles

Building towers in rural areas presents unique problems. Companies must deal with difficult terrain. They must also secure reliable power. Many rural towers rely on diesel generators. This is expensive and not sustainable. There is a strong push toward green energy solutions. This includes using solar power and battery storage. Overcoming these hurdles is essential for bridging the digital divide.

Right of Way (RoW) Policies

Securing permits, known as Right of Way, has historically been a challenge. Different states and local bodies had different rules. This caused long delays in tower construction. The government has worked to standardize these rules. The "GatiShakti Sanchar Portal" is a major step. It is a single, centralized platform for RoW applications. This policy reform helps speed up the deployment of towers and fiber.

The Role of Tower Companies (TowerCos)

The Indian telecom tower market is dominated by independent TowerCos. This business model is a key pillar of the industry's growth.

The Tower Sharing Model

In India, mobile operators do not typically own their towers. They sold their passive infrastructure to TowerCos. These TowerCos are independent companies. They build, own, and maintain the towers. They then lease space on these towers to multiple operators. This sharing model is highly efficient. It reduces capital costs for operators. It also speeds up the time to market for new services.

Key Players in the Indian Market

The Indian market is consolidated around a few large players. Companies like Indus Towers manage vast portfolios of tower sites. These TowerCos are experts in infrastructure management. They handle site acquisition, construction, and maintenance. This allows mobile operators to focus on their core business. That core business is providing wireless services to customers.

Investment and Monetization

TowerCos are a vital part of the investment cycle. They raise capital to fund new tower construction. This is essential for 5G densification. Operators can monetize their remaining tower assets by selling them. This frees up funds for 5G spectrum and equipment. This symbiotic relationship between operators and TowerCos fuels the entire network expansion.

Future Trends in India's Tower Infrastructure

The telecom tower of the future will look very different. Technology is driving a major shift in infrastructure design. The focus is moving beyond simple macro towers.

The Rise of Small Cells

5G network densification requires more than just macro towers. Small cells are a critical component. These are low-power, short-range sites. They are placed on street poles, building facades, and bus shelters. They are essential for providing high capacity in dense urban areas. The demand for small cell deployment is set to explode in India. This creates a new market for infrastructure providers.

The Critical Need for Tower Fiberization

A tower is only as good as its connection to the core network. This connection is called backhaul. For 5G, fiber optic backhaul is essential. It provides the high bandwidth and low latency that 5G promises. Currently, a low percentage of India's towers are connected with fiber. This needs to increase to at least 70% for a true 5G experience. Tower fiberization is a massive, ongoing infrastructure project. It is as important as building the towers themselves.

Green Energy Solutions

The energy cost for towers is a major operational expense. The reliance on diesel in off-grid areas is a problem. The industry is moving toward green telecom solutions. This involves installing solar panels at tower sites. It also includes using advanced battery storage systems. These solutions reduce operational costs. They also help meet sustainability goals. A green tower is more efficient and reliable.

India's Telecom Growth in a Global Context

India's telecom expansion is one of the largest in the world. This journey shares similarities with other nations. It also has unique characteristics. Understanding this telecom regional expansion provides valuable perspective.

Comparisons with Other Developing Economies

India's focus on connecting a vast rural population is a massive task. This challenge is mirrored in other large nations. For example, telecom tower installation in Indonesia faces extreme logistical hurdles due to its archipelagic geography. In Brazil, operators face requirements for communication tower construction in Brazil to cover huge land areas following 5G auctions.

Africa presents another strong parallel. Like India, Nigeria has a massive, mobile-first population. The demand for a cell tower near Nigeria is driven by data consumption. Kenya is emerging as a tech hub. The push for a 5G tower in Kenya supports its growing digital economy. These markets all show the same trend. Mobile infrastructure is the primary gateway to the internet.

Learning from Developed and High-Tech Markets

India can also be contrasted with more mature markets. In the United States, the focus is on extreme densification. A 5G tower installation in New York is often a small cell on a lamppost. This is a strategy India is now adopting for its own dense cities.

The Middle East offers a glimpse into smart city infrastructure. The investment in telecommunication towers in Dubai is driven by ambitious public projects. This is similar to India's own "Smart Cities Mission." These high-tech hubs require flawless connectivity.

Sourcing and Maintenance on a Global Scale

The challenges of sourcing and maintenance are universal. Finding a reliable mobile tower provider in Egypt is a key step for operators there. The same is true for finding a tower company near Arabi.

Maintenance is also critical. A robust plan for tower maintenance in Saudi Arabia ensures network uptime. This is just as vital as cell tower maintenance in Nairobi. These maintenance principles are the same in India. A large network requires a dedicated, skilled workforce to keep it running.

Strategic Opportunities in the Indian Market

The rapid expansion of India's telecom sector creates clear opportunities. The demand for new infrastructure is high.

Manufacturing and Supply Chain

There is a strong demand for tower components. This includes the steel structures, antennas, and power systems. The "Make in India" initiative encourages domestic manufacturing. This creates opportunities for companies that can produce high-quality telecom hardware locally. An efficient supply chain is a major competitive advantage.

Specialist Service Providers

The need for specialized services is growing. Companies that focus on tower fiberization are in high demand. Small cell deployment is another specialist area. It requires skills in radio frequency planning and urban site acquisition. Tower maintenance firms also have a major role. They ensure the long-term health of these critical assets.

Investment in TowerCos

Independent TowerCos remain an attractive investment. They have long-term contracts with mobile operators. This provides stable, predictable revenue. As data demand and tenancy ratios increase, their profitability grows. Investing in these infrastructure companies is a direct investment in India's digital future. This follows a global model of regional development in digital infrastructure.

Conclusion

Telecommunication towers in India are at the center of a digital revolution. The 5G rollout and soaring data use are driving historic demand. Government policies are helping to clear hurdles. The challenge of rural connectivity is being met with projects like BharatNet. The industry is evolving. It is moving toward a future of fiberized towers, small cells, and green energy. This massive expansion creates significant, long-term opportunities for investors, manufacturers, and service providers.

Hey, I’m Chunjian Shu

"X.Y. Tower: Reliable, innovative solutions for high-quality towers and electrical equipment with professional service.