Top Tower Companies Near Arabia Supporting Telecom Growth

2025-10-25

Top tower companies near Arabia are the essential foundation for the region's rapid digital transformation. The Arabian Peninsula, including key markets like Saudi Arabia, the UAE, and Egypt, is experiencing a massive surge in data demand. This growth is driven by ambitious national visions, 5G rollouts, and smart city projects. Mobile operators rely on expert tower companies to build, manage, and maintain the critical infrastructure that makes this connectivity possible.

This article explores the leading tower providers in the region, the services they offer, and the market dynamics shaping this vital industry.

The Strategic Importance of Telecom Infrastructure in Arabia

Telecommunication infrastructure is no longer just a utility. It is a core strategic asset for economic diversification across the Arabian Peninsula. Governments have launched ambitious plans that are entirely dependent on high-speed, reliable connectivity.

Saudi Arabia's Vision 2030

Saudi Arabia's Vision 2030 is the primary catalyst for infrastructure growth in the Kingdom. This national blueprint aims to create a thriving economy independent of oil. It focuses on developing sectors like tourism, entertainment, and technology. Mega-projects such as NEOM, a futuristic city, require a dense 5G network from the ground up. This has created an immense demand for new tower construction and advanced infrastructure solutions.

The UAE's Smart City Leadership

The United Arab Emirates, particularly Dubai, is a global leader in smart city development. Dubai's strategy involves integrating technology into every aspect of public life. This includes autonomous transportation, smart utilities, and AI-driven public services. This level of connectivity requires a flawless 5G network. This network relies on a dense web of macro towers and small cells. Tower companies are crucial partners in building this advanced urban environment.

Egypt's Role as a Regional Hub

Egypt is a critical market connecting the Middle East and Africa. With a large and growing population, the demand for mobile data is high. The government has recently launched 5G services. This is driving a new wave of network upgrades and tower construction. Egypt's position as a major data hub further emphasizes its need for robust telecom infrastructure.

Leading Tower Companies in Saudi Arabia

The Saudi Arabian market is the largest in the region. It is undergoing a significant transformation. The market is moving from operator-owned towers to an independent TowerCo model.

TAWAL: The Kingdom's Infrastructure Leader

TAWAL is the leading telecommunications tower company in Saudi Arabia. It was launched by stc Group and now operates as a major independent provider. TAWAL owns and manages a vast portfolio of over 21,000 towers across the Kingdom. The company's core business is providing colocation services. It allows multiple mobile operators, like stc, Mobily, and Zain KSA, to share the same tower. This sharing model reduces costs for operators and speeds up 5G deployment.

Focus on Colocation and New Site Builds

TAWAL's main services include building new sites to suit operator needs. They also offer colocation on existing towers. The company is heavily involved in the 5G rollout. It is deploying new types of infrastructure, including smart poles and in-building solutions. This supports the densification required for 5G. The company is also expanding its footprint internationally, showing its strength and expertise.

The Importance of Tower Maintenance in Saudi Arabia

With a growing network, the need for professional upkeep is high. A robust strategy for tower maintenance in Saudi Arabia is not just about repairs. It involves proactive management of power systems, structural integrity, and equipment. Companies like TAWAL provide these services. This ensures the network remains reliable. Reliable networks are essential for the critical data services supporting Vision 2030.

Key Infrastructure Providers in the UAE (Dubai)

The UAE market is mature and highly competitive. The focus here is on advanced solutions and urban densification. The tower market includes operator-led infrastructure and specialized contractors.

Operator-Led Infrastructure

In the UAE, major operators like Etisalat (e&) and du manage a significant portion of their own tower assets. They have extensive networks designed to provide high-quality service. They partner with construction and technology companies to build and upgrade their sites. The competition for 5G leadership is intense. This drives continuous investment in network quality.

The Role of Specialized Construction Companies

Specialized firms play a vital role in building this infrastructure. Companies like Al Babtain LeBLANC Emirates are well-known in the region. They design and manufacture various telecom structures. This includes monopoles, lattice towers, and rooftop solutions. They work with operators to execute complex projects. This is especially true in dense urban areas like Dubai.

Advanced Telecommunication Tower Dubai Solutions

Dubai's landscape demands more than just standard towers. The city requires "stealth" solutions. These are towers disguised as palm trees, minarets, or flagpoles. This helps them blend into the urban environment. There is also a huge demand for in-building solutions (IBS). These systems provide strong 5G coverage inside skyscrapers, malls, and airports. Building a telecommunication tower in Dubai means providing these sophisticated, high-tech solutions.

The Telecom Tower Market in Egypt

Egypt's telecom market is large and has high growth potential. The recent 5G launch in 2025 has created a new wave of demand. Operators are investing heavily to upgrade their networks.

A Market in Transition

Historically, operators in Egypt owned and managed their own towers. This is now changing. The government and operators see the value of the TowerCo model. This transition is opening the market to independent infrastructure providers. International TowerCos are showing strong interest in this market. They see an opportunity to acquire tower portfolios from operators.

Finding a Mobile Tower Provider Egypt

Operators like Vodafone Egypt, Orange, and Etisalat (e& Egypt) are the main clients. They need partners for their 5G rollout. Finding a reliable mobile tower provider in Egypt is key. This includes companies that can manufacture towers. It also includes service providers for installation and maintenance. Local companies and international firms are competing for these contracts. The launch of 5G by all four operators in 2025 has made this a top priority.

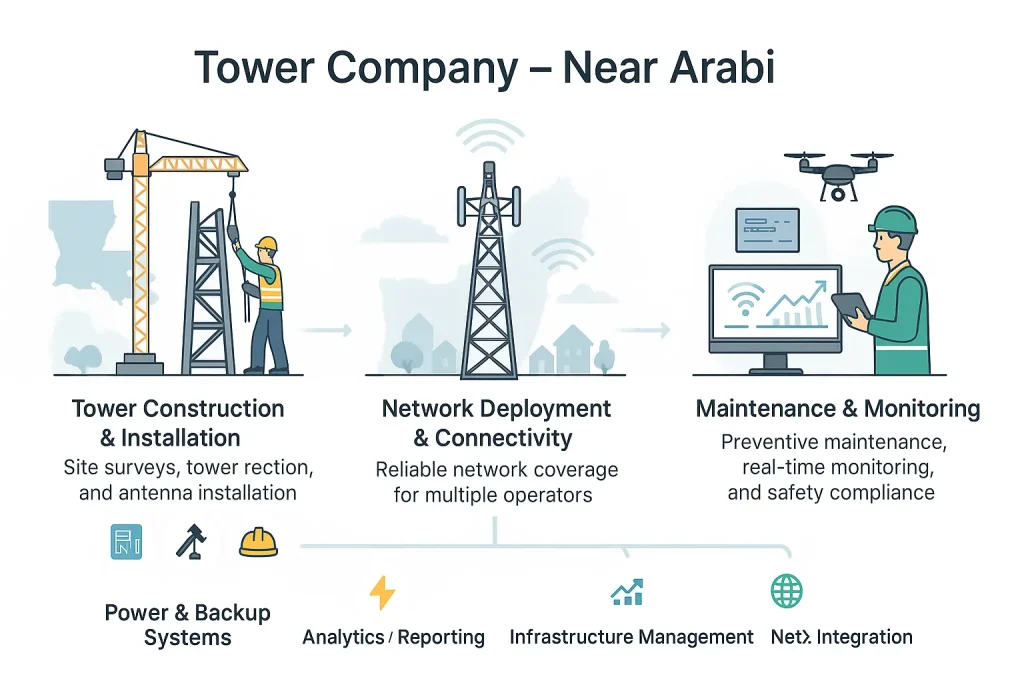

Locating a Tower Company Near Arabi: Services and Solutions

Selecting the right tower company near Arabi is a critical decision for operators. These partners provide more than just steel. They offer a range of end-to-end services.

Core Services Offered

A full-service tower company provides a complete lifecycle of solutions.

- Design and Engineering: Creating tower designs that meet specific load, height, and environmental standards.

- Manufacturing: Fabricating the tower structures, such as monopoles, lattice towers, and guyed masts.

- Site Acquisition: Finding and securing the land and permits for new tower locations. This is often a complex process.

- Installation and Construction: Managing the civil works, tower erection, and equipment installation.

- Operations and Maintenance: Providing 24/7 monitoring, preventive maintenance, and emergency repairs.

Types of Tower Structures

Tower companies in the region must offer a diverse portfolio.

- Lattice Towers: These are self-supporting, three- or four-legged towers. They are very strong and can support heavy equipment loads.

- Monopoles: These are single-pole structures. They have a smaller footprint and are often used in urban areas where space is limited.

- Stealth Structures: These are disguised towers. They are essential for gaining permits in aesthetically sensitive areas.

- Rooftop Sites: These are mounts and structures placed on top of buildings. They are a key part of network densification in cities.

Green Energy Solutions

Powering towers is a major operational cost. This is especially true for off-grid sites. Many sites in remote desert areas rely on diesel generators. Tower companies are now focusing on green energy. This includes hybrid solutions. They combine solar panels and battery storage with the grid or a generator. This reduces fuel costs, lowers emissions, and improves network reliability.

Regional Context: The Arabian Market and Global Telecom Regional Expansion

The growth in Arabia is part of a larger global trend of telecom regional expansion. Comparing this region to others provides valuable insight into its unique challenges and opportunities.

Lessons from Asian High-Growth Markets

The scale of expansion in Arabia is massive. It finds parallels in Asia's largest markets. India, for example, is undergoing a huge 5G rollout. The demand for telecommunication towers in India is driven by a billion users. This market shares the challenge of connecting a vast and diverse population.

Logistical challenges are also similar. The work of telecom tower installation in Indonesia is complicated by its geography of thousands of islands. This is similar to the challenge of building sites in remote desert or mountainous areas of Saudi Arabia. Both require expert project management.

Parallels with African Digital Transformation

Arabian markets like Egypt form a bridge to Africa. The African continent is a mobile-first economy. This is driving huge demand for infrastructure. The need for a cell tower near Nigeria is high. This is to support its large population and data-hungry users.

Kenya is also a key tech hub. The push for a 5G tower in Kenya is about enabling a new digital economy. This is similar to the goals of Saudi Vision 2030. In both regions, infrastructure is the enabler. As these networks grow, maintenance becomes vital. The need for cell tower maintenance in Nairobi is just as critical as it is in Riyadh. It ensures the network's long-term value.

Benchmarking Against American Markets

The densification strategies in Arabia's smart cities can be benchmarked against Western markets. The 5G tower installation in New York relies heavily on small cells. These are placed on streetlights and buildings. Dubai is using this same playbook.

However, the region also shares challenges with South America. The need for communication tower construction in Brazil involves covering vast territories. This is part of 5G auction requirements. This is similar to the need to cover large, sparsely populated areas of Saudi Arabia.

The Importance of Regional Development Policies

In all these cases, government policy is key. National visions and regional development plans are the driving force. These policies set the targets for 5G, rural coverage, and smart cities. Tower companies that align with these national goals are the most successful. They become partners with the government. They help achieve the country's digital ambitions.

Future Trends for Tower Companies in Arabia

The telecom tower industry in Arabia will continue to evolve. Several key trends are shaping its future.

Market Consolidation

The TowerCo model is proven. We can expect to see more consolidation. Operators in markets like Egypt and the UAE may sell their tower portfolios. This allows them to raise capital. It creates larger, more efficient independent TowerCos. Companies like TAWAL, Helios Towers, and IHS Towers are all active in the greater region. They are looking for such opportunities.

The Rise of Small Cells and DAS

5G is not just about macro towers. As data traffic grows, networks will be densified. This means a massive rollout of small cells. It also includes Distributed Antenna Systems (DAS) for in-building coverage. Tower companies are evolving. They are becoming "digital infrastructure providers." They will manage these new types of assets. They will offer fiber connectivity and edge computing.

Focus on Sustainability and Efficiency

Sustainability is a key priority. This is part of national visions in the region. Tower companies are under pressure to reduce their carbon footprint. The shift to green energy solutions will accelerate. Predictive maintenance will also be key. Using AI and sensors to monitor towers will improve uptime. It will also reduce operational costs.

Conclusion

Top tower companies near Arabia are more than just steel fabricators. They are fundamental partners in the region's economic and social development. They are building the physical infrastructure for 5G, smart cities, and national digital visions. Companies in Saudi Arabia, the UAE, and Egypt are enabling this transformation. They provide the expertise to build, manage, and maintain complex networks. As the demand for data continues to grow, the role of these infrastructure providers will only become more critical.

Hey, I’m Chunjian Shu

"X.Y. Tower: Reliable, innovative solutions for high-quality towers and electrical equipment with professional service.